I’m Luis Kury from Class of 2026, and for my Personal Project I’ve gotten myself educated on the ups and downs of Short-Term Stock Investing, where I’ve made over $500 in a span of 3 months only requiring my weekends and some small check-ups around 2am during school days. This is the highly-lucrative art of trusting in highly-versatile stocks that can either win you hundreds of %s in profit or sweep your money away completely, all of this can be done in periods less than a year!

Hopping onto the journey of full-on stock investing may seem like a true hardship, especially for middle and high school students like us. However, the world of finance is not exclusive to adults, and the potential for building wealth can start at a young age. This article aims to introduce Baldwin middle and high schoolers to the key aspects and strategies of short-term stock investing. By understanding the pillars outlined below, young investors can grasp the fundamentals of the stock market and pave the way for financial success even before graduating the 12th grade.

Understanding the Basics

To begin your journey in short-term stock investing, it’s crucial to understand the fundamentals. Stocks represent ownership in a company, and their values fluctuate based on various factors such as company performance, economic conditions, and market sentiment.

As a young investor, start by learning basic financial terms, stock market mechanics, and how to read stock charts. Most importantly, stay peeled to business newsletters such as Bloomberg, Forbes and Insider that immediately notify you on a company’s future ventures or predicted calendar for the week, which can help you take the right turns while dealing with shares. (Trust, it helped me tons)

Risk Management

One of the key aspects of successful short-term investing is effective risk management. Diversifying your investment portfolio and avoiding putting all your funds into a single stock can help shrink your risks. Keep an eye for safety stocks and new-coming companies that have a decent amount of potential.

Technical Analysis

Learning the basics of technical analysis can provide valuable insights into short-term market movements. Chart patterns, indicators, and trend analysis can help you identify potential entry and exit points for your trades. While technical analysis is just one tool in the investor’s toolkit, understanding these aspects can enhance your decision-making process. For me this has been the hardest part of the venture since there isn’t an exact crystal-clear science to understand stock dynamics entirely. Stick to a single source credible to the topic, avoiding any confusion with different theories on the market.

Setting Realistic Goals

Establishing clear and achievable financial goals is vital for any investor. Define your investment objectives, whether they be saving for the new Travis 1s, Snapchat Premium, or any future entrepreneurship. Having specific and measurable goals will guide your investment strategy and help you stay disciplined in your approach. Also, don’t think you are going to triple your portfolio capital overnight, although there is always a possibility, most investors spend years expanding their measure of shares.

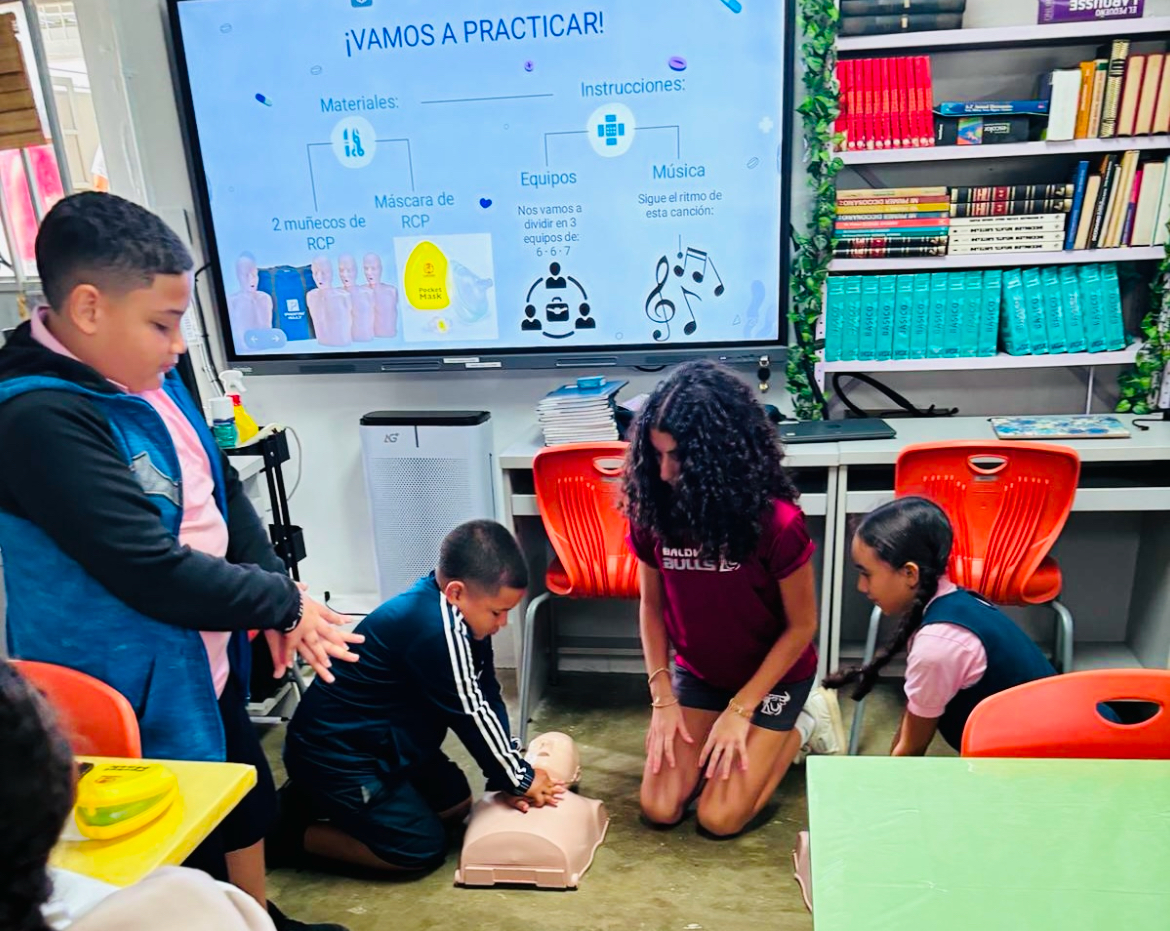

Practice with Simulated Trading

Before risking real money, consider practicing with simulated or paper trading platforms. These tools allow you to experience the dynamics of the stock market without financial consequences. Use this opportunity to test different strategies, refine your skills, and gain confidence in your ability to navigate the market. Most of my project was based on a simulator, where I could replicate the investments of certain finance connoisseurs in order to gain a better understanding of the job.

Continuous Learning and Adaptation

The financial markets are dynamic, and successful investors are lifelong learners. Stay curious, seek knowledge from credible sources, and adapt your strategies as needed. The ability to learn from both successes and setbacks is a crucial aspect of becoming a natural and successful investor.

Short-term stock investing may seem daunting at first, but with the right knowledge and strategies, middle and high schoolers can embark on a journey to financial success. By grasping the key aspects discussed in this article – from understanding the basics and managing risks to conducting thorough research and setting realistic goals – young investors can lay the groundwork for building wealth at an early age. Remember, the world of finance is a realm of continuous learning and adaptation, and with dedication, discipline, and a strategic mindset, the potential for high income is well within reach, even before graduation.

*This is an article that I wrote for the official school newsletter during early January 2024.